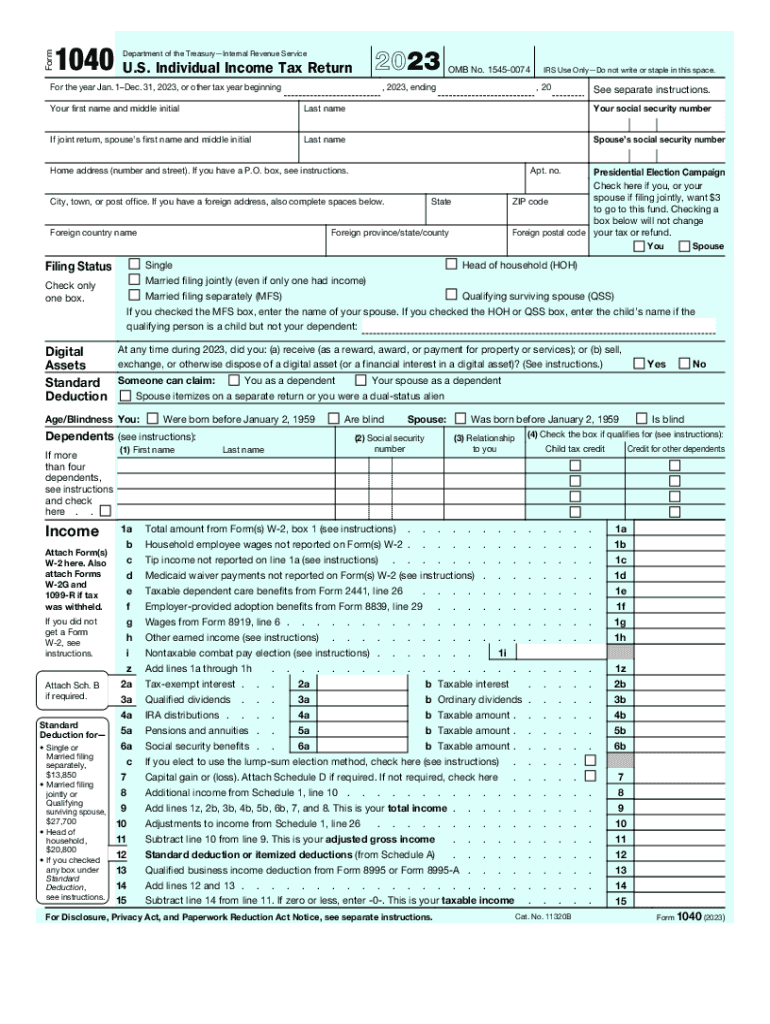

2024 Form 1040 Schedule Builder – You report commercial sales tax to the IRS on Schedule C, a supplemental sheet of the 1040 group of forms. Form 1040, Schedule C Use Schedule C to report all financial activity from your business. . The 1099 forms are sent to you by clients you work for. Complete IRS form 1040 “Schedule C, Profit or Loss From Business.” Complete IRS Form 1040 Schedule SE, “Self-Employment Tax.” .

2024 Form 1040 Schedule Builder

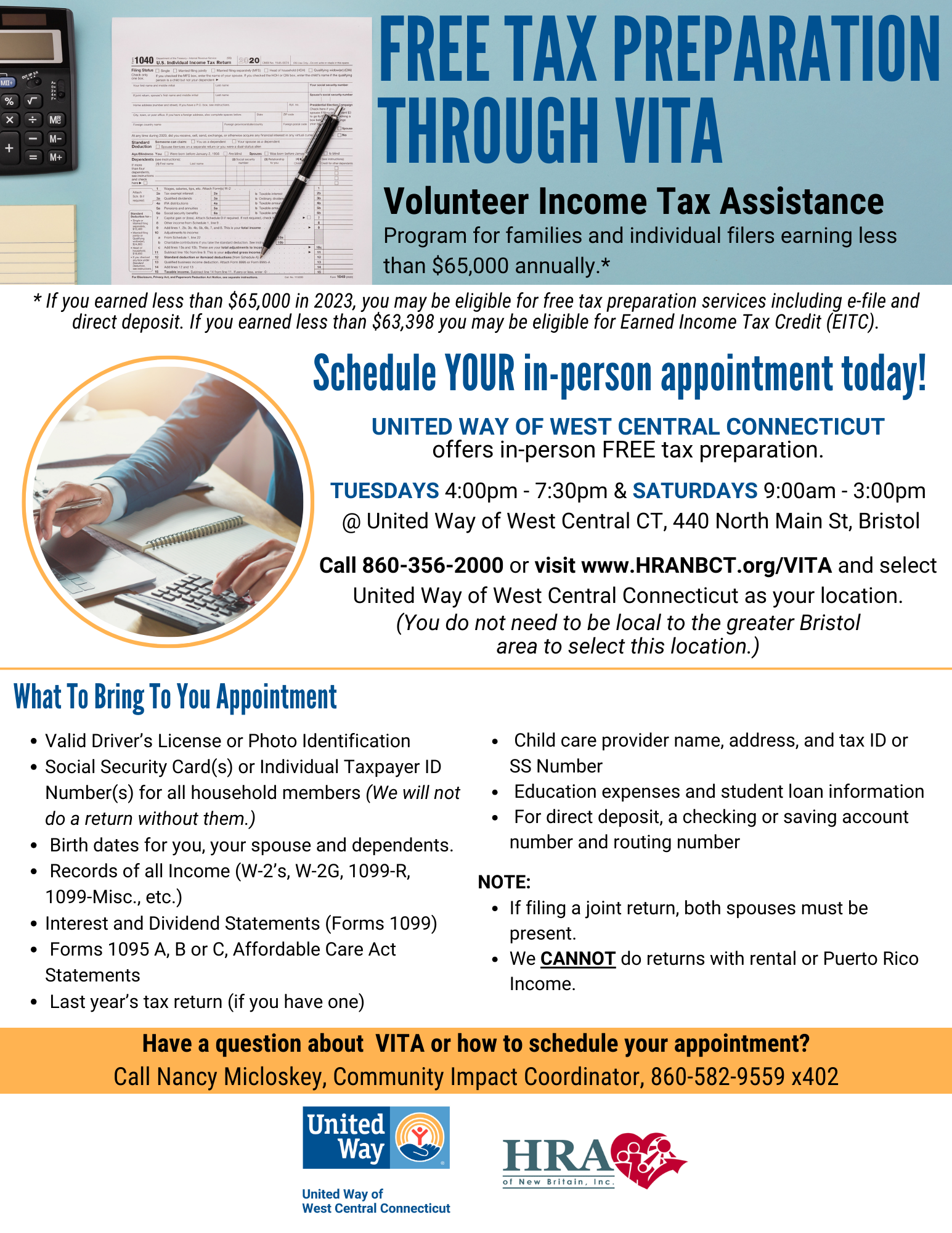

Source : 1040-form.pdffiller.comFree Tax Preparation Service | United Way of West Central Connecticut

Source : www.uwwestcentralct.orgMaryland Society of Accounting & Tax Professionals, Inc. | Owings

Source : www.facebook.comTax Preparation

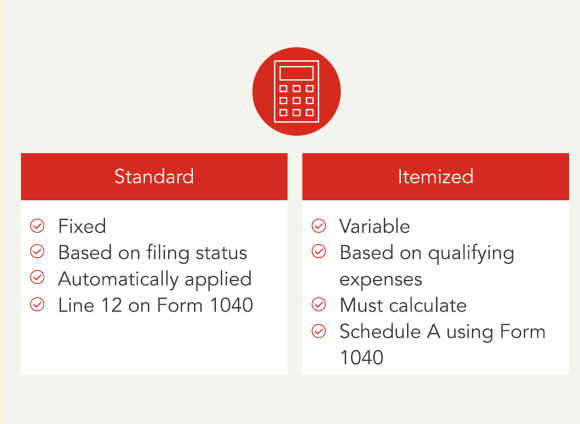

Source : www.kbcc.cuny.eduAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

How to Report Crypto on Taxes: Forms 8949 & Schedule D | Koinly

Source : koinly.ioWhat Are Tax Deductions? A 101 Guide The TurboTax Blog

Source : blog.turbotax.intuit.comBurlington Community Financial Center | Burlington MA

Source : m.facebook.comPoll: Most Americans feel they pay too much in taxes | WPRI.com

Source : www.wpri.comUnited Way of Ross County | Chillicothe OH

Source : www.facebook.com2024 Form 1040 Schedule Builder 2023 Form IRS 1040 Fill Online, Printable, Fillable, Blank pdfFiller: In other words, taxpayers with uncomplicated tax situations will likely fill out Form 1040. Your 1040 will come with a number of schedules – like Schedule 1 and Schedule A – that are . Depending on the type of activity, you’ll report your crypto gains and losses on Form 1040 Schedule D, or crypto income either on Form 1040 Schedule C for self-employment earnings or Form 1040 .

]]>

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)